Below is based on a Facebook response I wrote to someone asking for evidence that the GFC caused peak oil.

The often cited cause of the GFC was sub prime mortgages in the USA. People who purchased crappy housing with little to no risk on their part.

But why is it that the deal seemed good but then lots of these people couldn’t pay? Because the price of oil went up and like a rising tide that lifts all boats the costs of nearly everything goes up with it…. But wages don’t increase with it. So lots of people defaulted.

Also, ask yourself why some people not paying off some housing in America would cause a GLOBAL financial crisis where countries like Greece are still reeling from the effects?

Peak Oil production was actually hit in 2006 ( according to the International Energy Agency’s 2010 report http://www.resilience.org/stories/2010-11-11/iea-acknowledges-peak-oil ) and has basically kept at around the same level of production for a while. The price spike didn’t happen until 2008 thanks to existing oil reserves ( many of which were brought out of the ground by the derivatives market especially by people with memory of the 1970’s oil crisis in America ), plus things like the exponentially rising demand for oil as Dr Albert Bartlett explains so well in the presentation ‘Arithmetic, Population and Energy’

[youtube]http://www.youtube.com/watch?v=umFnrvcS6AQ[/youtube]

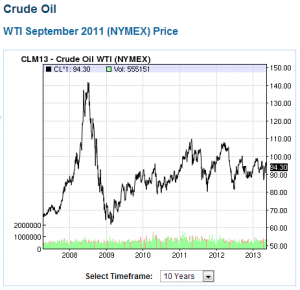

As predicted more than 20 years ago and as you can see in the 5 year graph of crude oil prices at http://www.oil-price.net/index.php?lang=en in 2008 there was a spike in oil prices around the time of the GFC, it then fell ( as people used less oil ) and prices have been going through the expected cycle of rising then people using less because of the higher prices which reduces demand and causes the price to fall, the lower prices then mean people use it more so the price increases until people use it less, etc..

The 10 year chart at http://www.nasdaq.com/markets/crude-oil.aspx?timeframe=10y is probably a better view of it all.

If you want an economist which talks about this then Jeremy Rifkin does although what he talks about is so good that you should watch the whole thing ( short version provided if you don’t have much time the long version if you can’t keep up with the dubstep speed ).

The short version (for those without much time)

[youtube]http://www.youtube.com/watch?v=_lsgiwTAv_8[/youtube]

The longer version (for those that can’t understand the dubstep version)

[youtube]http://www.youtube.com/watch?v=1-7BjeHepbA[/youtube]